InfoCons Consumer Protection Alert : Porsche – Passenger car

Porsche – Passenger car

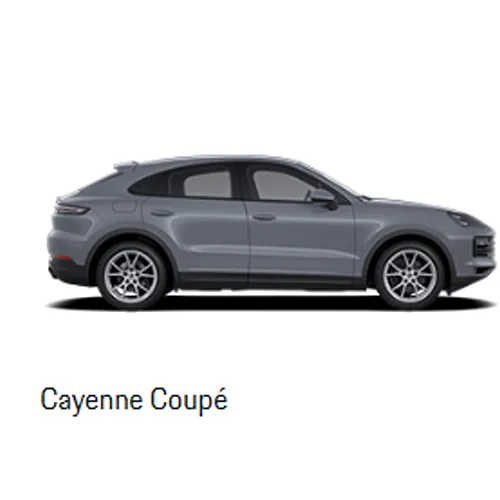

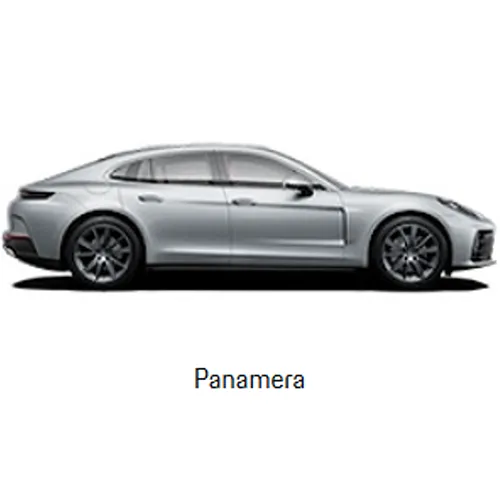

Name: Cayenne, Cayenne Coupe, Panamera

Category: 10

Date: 2025-12-19

Product Category: Motor vehicles

Risk Type: Fire

Danger: The screw connections of the high-pressure pumps are incorrectly tightened. As a result, the screw connection between the high-pressure pump and the fuel pipes may be faulty. This could cause fuel leakage and a fire. The product does not comply with the Regulation on the approval and market surveillance of motor vehicles and their trailers, and of systems, components and separate technical units intended for such vehicles.

Measures: Type of economic operator taking notified measure(s): OtherCategory of measure(s): Recall of the product from end usersDate of entry into force: Unknown

Description: Passenger car

Notifying Country: Germany

Country of Origin: Germany

Alert Type: Consumer

Alert Level: Serious risk