InfoCons Consumer Protection Alert : Sweet Years – Perfume

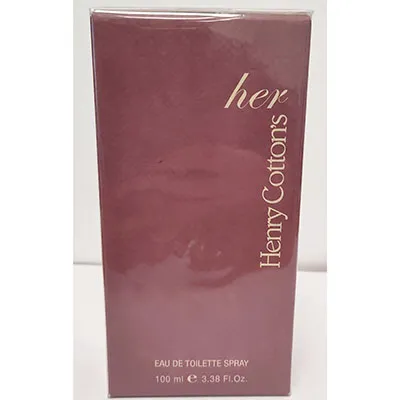

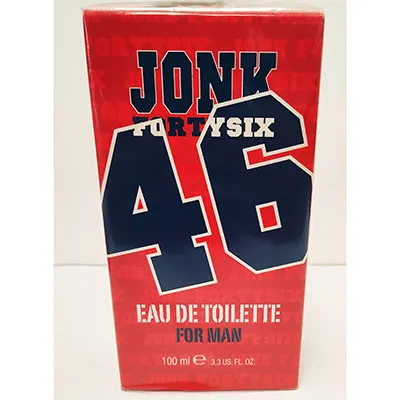

Sweet Years – Perfume

Name: Funky Music

Category: 10

Date: 2025-12-12

Product Category: Cosmetics

Risk Type: Chemical

Danger: According to the list of ingredients, the product contains 2-(4-tert-butylbenzyl) propionaldehyde (BMHCA), which is prohibited in cosmetic products. BMHCA may harm the reproductive system, may harm the health of the unborn child and may cause skin sensitisation. The product does not comply with the Cosmetic Products Regulation.

Measures: Type of economic operator to whom the measure(s) were ordered: DistributorCategory of measure(s): Ban on the marketing of the product and any accompanying measuresDate of entry into force: 17/09/2025

Description: Eau de parfum, intended for women.

Notifying Country: Italy

Country of Origin: Italy

Alert Type: Consumer

Alert Level: Serious risk